Benefits of the Top 10 Odds - Sep 29, 2022 Performance Breakdown (S&P 500)

Sep 29, 2022

The following showcases potential results from The Top 10 Odds (S&P 500) basket for September 29, 2022. This is using the v2.1 algorithm, which selects 10 longs and 10 shorts from the S&P 500 index.

Below is an annotated 5-minute chart for SPY on September 29 for overall context of market moves.

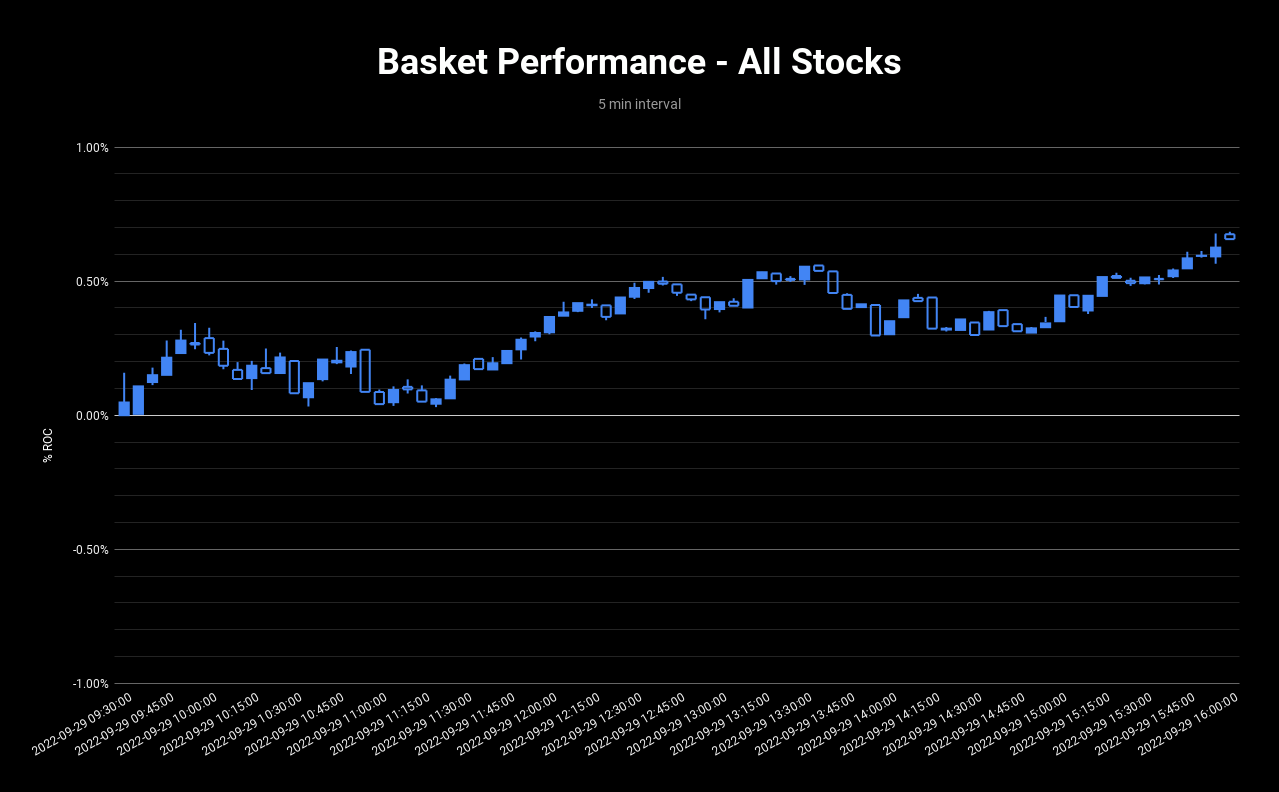

Below is the intraday performance from open to close (OC) of the various baskets consisting of 10 long stocks, 10 shorts, and then a combined basket with all 20 symbols. The performance is measured in ROC, which is "Return on Capital." This is calculated by taking the return for the day (+$122.65) and dividing it by the total capital used ($10,000 long + $10,000 short = $20,000), thus +$122.65 / $20,000 = +0.61% ROC.

StockOdds Selection

These stocks were selected the evening of September 28th for Trading at the Open Auction or before the open if advantageous. The stocks could be held until the Closing Auction at 4:00pm ET or could be closed out during the day in a variety of ways.

StockOdds Criteria

Our Algo selected these using a variety of factors/signals like RSI 2 and using the displayed Odds & Average Performance selected symbols for Open to Close today, September 29th

There was no human vetting such as news considered or what the stocks were doing premarket. No consideration for Sector performance or Market Sentiment.

An equal amount of capital was applied to each symbol.

Market Orders for the Open (OPG) were used to establish the positions. Market on Close Orders (MOC) were used to close the positions.

This is what we at StockOdds, Inc. refer to as a “baseline” approach. The question is; can the human do better? There are a variety of ways to optimize, such as better position sizing (volatility, beta, risk factors), and executing

Limit Orders versus Market Orders, or closing positions early and locking profits along the way.

These optimization techniques are for subscribers to learn in our Learning Academy or implement their own ideas and models of managing baskets.

The key to Basket Trading is Relative Performance. Simply put, you want your Longs to Outperform your Shorts regardless of market direction.

Why not traded hedged, overcome the noise and whipsaw, and be more consistent with lower variance?

Check out the Top 10 Odds here

Start Trading with Odds

Get access to the Seasonality Almanac Dashboard, as well as 1 basic course, for free!