Trader Talk: Window Dressing

Jun 30, 2023

The following is a chat between Rob and one of the many traders helps coach. The chat took place the morning of June 30, 2023 and takes a look at the effect of Window Dressing at the end of the month/quarter as money managers add or remove certain stocks in their portfolio.

Trader, 7:08 AM

Impressive action after a big gap up. Guessing this is the institutions buying the performers of the quarter

Rob, 9:08 AM

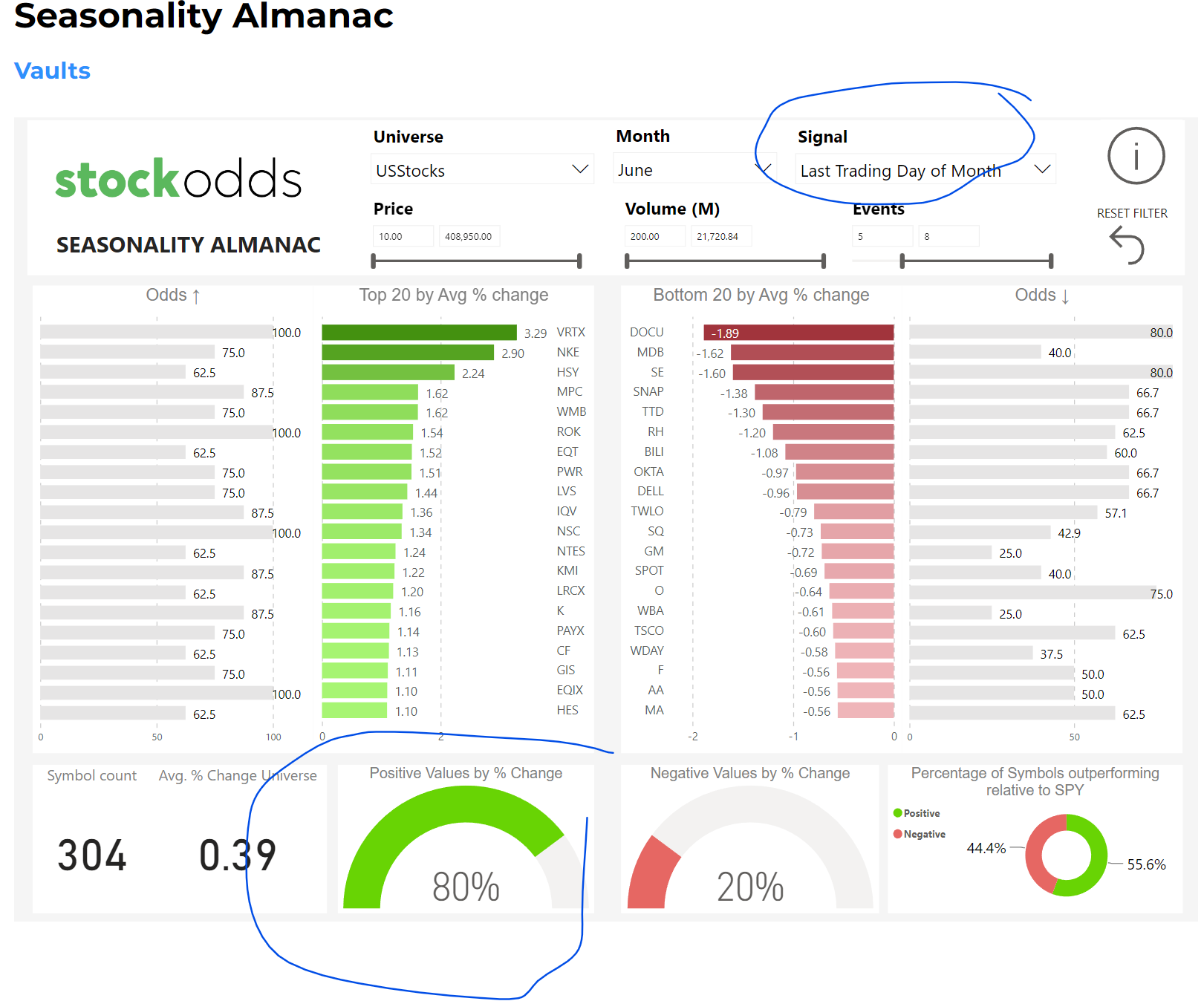

I have compared a lot of groupings and pairs and about 80% of this is window dressing

here is two examples...but you can look for a lot more

NFLX vs DIS

WMR vs TGT

you get the point

last day of month of June seasonality for SPY is bullish as well as some nuggets to utilize on the Symbols that perform vs those that don't

That Seasonality performance is from Previous Close to Today's Close

How do you navigate the premium we had at the open? I wouldn't blame a trader for having hesitancy despite the bullish seasonality

it is not easy but if you have your pairings like WMT vs TGT... you would have more confidence

reason: TGT still got pulled up with an up open due to the market gapping

that's a great point, I wasn't thinking of window dressing in the context of pairs, only thinking about it in terms of which sectors would be hot and which would not

baskets long and short can be made up of pairs

its quite simple to go through a group like big box stores and look at the quarterly performance and EXPECT window dressing

again...this goes back to some of our previous discussions

when did you know about the Seasonality for today for MU for example?

Last July :)

as 11 months ago...this calendar was the in place for today

when did you know about TGT sucking vs WMT performing well?

Middle of May

so Trading is about forward vision through research, observations, sentiment, macro and statistical information

so anticipating what the institutions have to do is very important

Break it down like this. Most money in the world in the markets is Managed Money or OPM (other peoples money)

People are responsible to do their best to handle that money. They have bosses and managers to please.

So what would the person feel like, what would they do, what do they want to show on the "books" for the month, quarter, semester, YTD ?

No...we don't have any TGT...we own WMT .... whoop whoop

so you think forward about what people have to do, want to do, will probably do

so in that sense there are spectacular OVERNIGHT Trades...not just Intraday only

Start Trading with Odds

Get access to the Seasonality Almanac Dashboard, as well as 1 basic course, for free!