The following is a chat between Rob and one of the many traders he helps coach. The chat took place the morning of September 2, 2023 and takes a look at IF-THEN statements,...

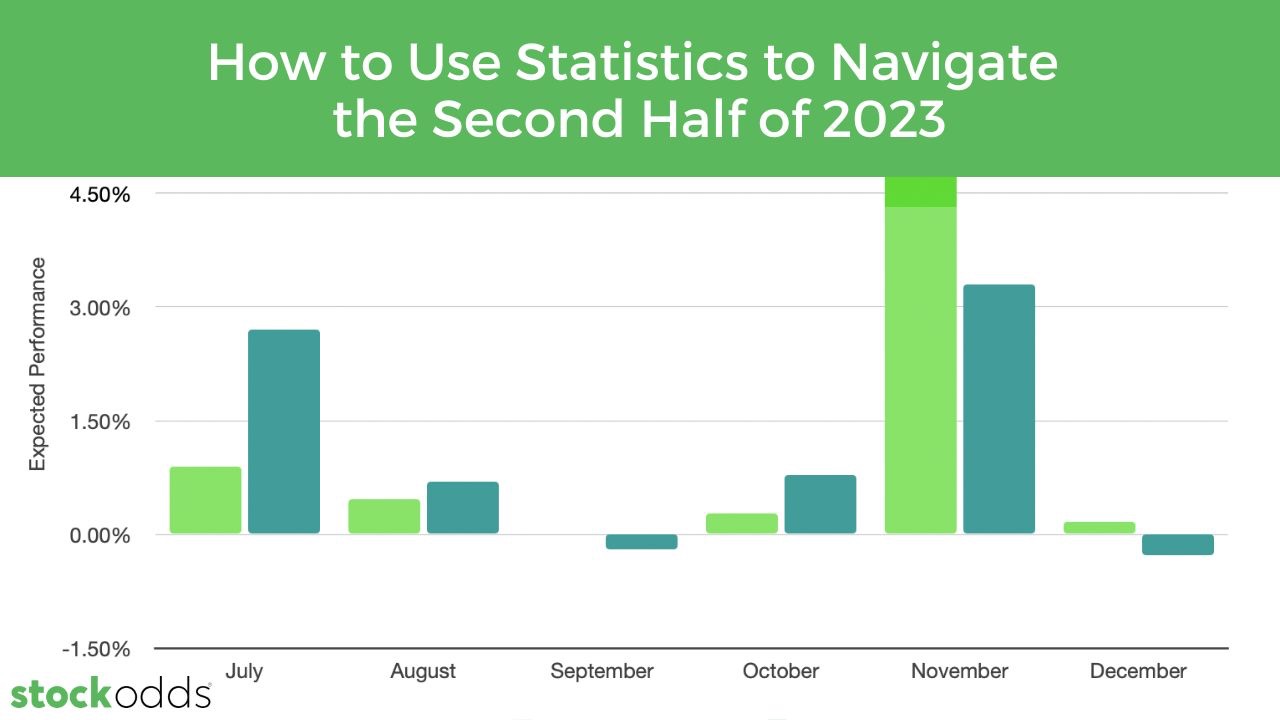

As we step into the second half of 2023, the financial landscape seems to be shrouded in a cloud of uncertainty, with many fund investors and fund managers admitting they don't know where to go...

The following is a chat between Rob and one of the many traders he helps coach. The chat took place the morning of July 14, 2023 and takes a look at the latest bank earnings and...

The following is a chat between Rob and a couple of the many traders he helps coach. The chat took place the morning of July 12, 2023 and takes a look...

The following is a chat between Rob and one of the many traders he helps coach. The chat took place the morning of June 28, 2023 and takes a look at the tech sector, how to determine...

The following is a chat between Rob and one of the many traders helps coach. The chat took place the morning of June 30, 2023 and takes a look at the effect of Window Dressing at the end of...

What is Mean Reversion?

Mean reversion is a theory used in finance that suggests asset prices and returns eventually reverts to their long-term mean or average.To put in similar terms, mean...

On the morning of April 17th, the USD moved higher, impacting the basic materials sector, primarily metals and also chemicals. Currency fluctuations can be utilized as catalysts for basket trading,...